Bad Credit:

What is It, and How Do You Deal with It?

The first obstacle you need to deal with as you set out to restore bad credit ratings is to make sure you fully understand the problem.

Maybe you are aware of having a “credit issue”, or it might just be something you began suspecting when that loan you applied for got denied.

Whatever the case, your first stop on the road to get your credit repaired is always the same – you need to learn exactly what “bad credit” means and where it comes from. Otherwise, trying to fix bad credit becomes like trying to solve a puzzle when you can’t even see the shapes of the pieces.

So, let’s start by breaking down the matter into easy to grasp questions with straightforward answers, and move on from there onto how you can go about fixing it.

What Exactly is Bad Credit?

Within the context of doing business with financial entities – like applying for loans, financing for a vehicle, or requesting a new credit card – “bad credit” refers merely to a person’s existing record of failure to meet payments on credits and other financial obligations.

In those instances, a person may find themselves unable to get approved – or even qualify – for new credits and similar financial products.

Where Does It Come From?

When someone says you have “bad credit” or a “bad credit score”, it’s usually through the lens of a credit report.

These reports come from data collection agencies – sometimes called credit bureaus – and are routinely consulted by financial institutions when they have to decide whether or not to lend money or extend some credit to someone.

The reports are compiled from legally available information, credit history, and public records – like state or federal tax liens, bankruptcies, and even legal judgments against you – and serve as the basis to generate credit scores.

An important note here is that different agencies maintain their own separate reports. This means that your credit history, reports, and scores can vary from one another.

So… Credit Scores?

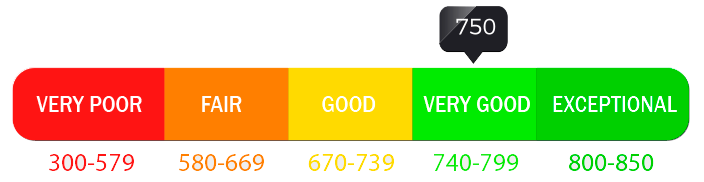

760 – 850

Qualify for the best interest rates possible. Fill out our form and check the top lenders competing for your business.

700 – 759

Qualify for interest rates just a step down from the top rates. Plenty of lenders offer really competitive rates with very low down payments.

660 – 699

You have a good credit. You will have no problem getting a loan, but only at average interest rates unless you know where to look.

620 – 659

This is an average credit. There are plenty of loan programs and options. FHA, VA, USDA and conventional loans are within your reach.

580 – 619

This is what many call “subprime” credit. You’re in luck, you may still be eligible for a home loan with FHA and VA. FHA will require a 3.5% down payment, but be prepared for a higher interest rate. We have several lenders that can help with this type of credit profile.

300 – 579

It is very difficult to get a mortgage loan in this range. FHA is a possible option but you will need at least 10% down payment. We have a few lenders that can help if you have the down payment.

Credit scores are nothing more than the numerical expression of an analysis based around a person’s credit history, and it’s intended to accurately represent the likelihood – or lack thereof – of them fulfilling their financial obligations.

Bad credit, then, is often used interchangeably to refer to a person’s bad credit history and/or low credit score.

In the U.S. the term most likely refers to a low FICO score, which is the model used by the vast majority of banks and credit grantors in the country.

How are FICO Scores Calculated?

FICO (Fair Isaac Corporation) is a data analytics company focused on credit scoring services, and came up with the process, algorithms, and software to calculate this score.

It’s based around consumer credit files from the three national credit bureaus: Equifax, Experian, and TransUnion. As mentioned before, as each credit file may contain different information at each bureau, it isn’t unusual for the scores to vary depending on which one provides the information to FICO to generate the score.

Furthermore, different companies – auto lenders, credit card companies, mortgage lenders – analyze their clients via various criteria, which means there are dozens of FICO score variations.

Fico scores range from 300 to 850, and can be roughly considered in this spread:

Each organization may have a different valuation depending on their credit in question, sometimes considering a score of 650 still within the “Good” parameter.

The exact formulas for calculating credit scores are understandably secret – and may vary depending on a number of factors – but FICO has disclosed a broad view of the most critical elements that come in play.

- Payment History: 35%

- Debt Burden: 30%

- Lenght of Credit

History: 15% - Types of Credits

Used: 10% - Recent Credit

Applications: 10%

How Do Bad Credit Scores Affect Interest Rates and Monthly Payments?

Now that we know precisely what we are dealing with, it’s easier to understand how a bad credit score affects your finances, another step on your journey to credit repair.

As you can imagine, having a poor credit score directly impacts many of the financial activities you might be interested in, like getting financial instruments approved, such as credit cards, can be more difficult. Some insurance companies are known to take low credit scores into account when calculating insurance policy prices, and people with low credit score have trouble finding lenders willing to do business in spite of the higher risk (Something we can help you with CLICK HERE so we can match you with lenders that meet up to your credit profile needs).

But most often than not, a direct consequence of having a low credit score is that you start seeing higher interest rates and monthly payments from credit card companies and other financial institutions when you do get accepted for a loan.

These increased interest rates are a way for the lender to compensate themselves for the higher risk of loaning money to someone who represents a higher risk of failing to keep up with expected payments.

Step-By-Step Reference Guide

To Credit Repair:

However, we want to get you started on finding the solution to your credit problems right away, so we’ve put together a simple-to-follow reference checklist, covering the broad steps you need to take care of to get your lousy credit repaired, and further information that will aid you to do so.

You’ll notice links along the checklist; these lead you to more detailed guides and further resources relevant to that particular step.

- Start Reducing The Amount of Debt You Currently Owe

- Start Fixing Your Payment History

- Improve Your Length of Credit Situation

- Start building Good References with New Credit

- Learn New Money and Credit Management Practices

Credit Reporting

Your credit report contains your credit history as reported to the credit reporting agency by lenders who have extended credit to you. The information in your credit report is also used to generate credit scores such as your FICO® Scores.

Your credit report lists what types of credit you use, the length of time your accounts have been open, and whether you’ve paid your bills on time. It tells lenders how much credit you’ve used and whether you’re seeking new sources of credit. It gives lenders a broader view of your credit history than do other data sources, such as a bank’s own customer data.

Credit reporting agencies:

How-To Guides

Need a better understanding of bad credit and how to fix it? Our finance experts have put together a series of step-by-step guides on a variety of bad credit related subjects.